Condo Insurance in and around Spartanburg

Here's why you need condo unitowners insurance

Cover your home, wisely

Your Possessions Need Protection—and So Does Your Condo.

When looking for the right condo, it's understandable to be focused on details like cosmetic fixes and neighborhood, but it's also important to make sure that your condo is properly covered. That's where State Farm's Condo Unitowners Insurance comes in.

Here's why you need condo unitowners insurance

Cover your home, wisely

Protect Your Home Sweet Home

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has dependable options to keep your most personal possessions protected. You’ll get coverage options to fit your specific needs. Thank goodness that you won’t have to figure that out alone. With empathy and remarkable customer service, Agent Chesley Ricketts can walk you through every step to help provide you with coverage that guards your condo unit and everything you’ve invested in.

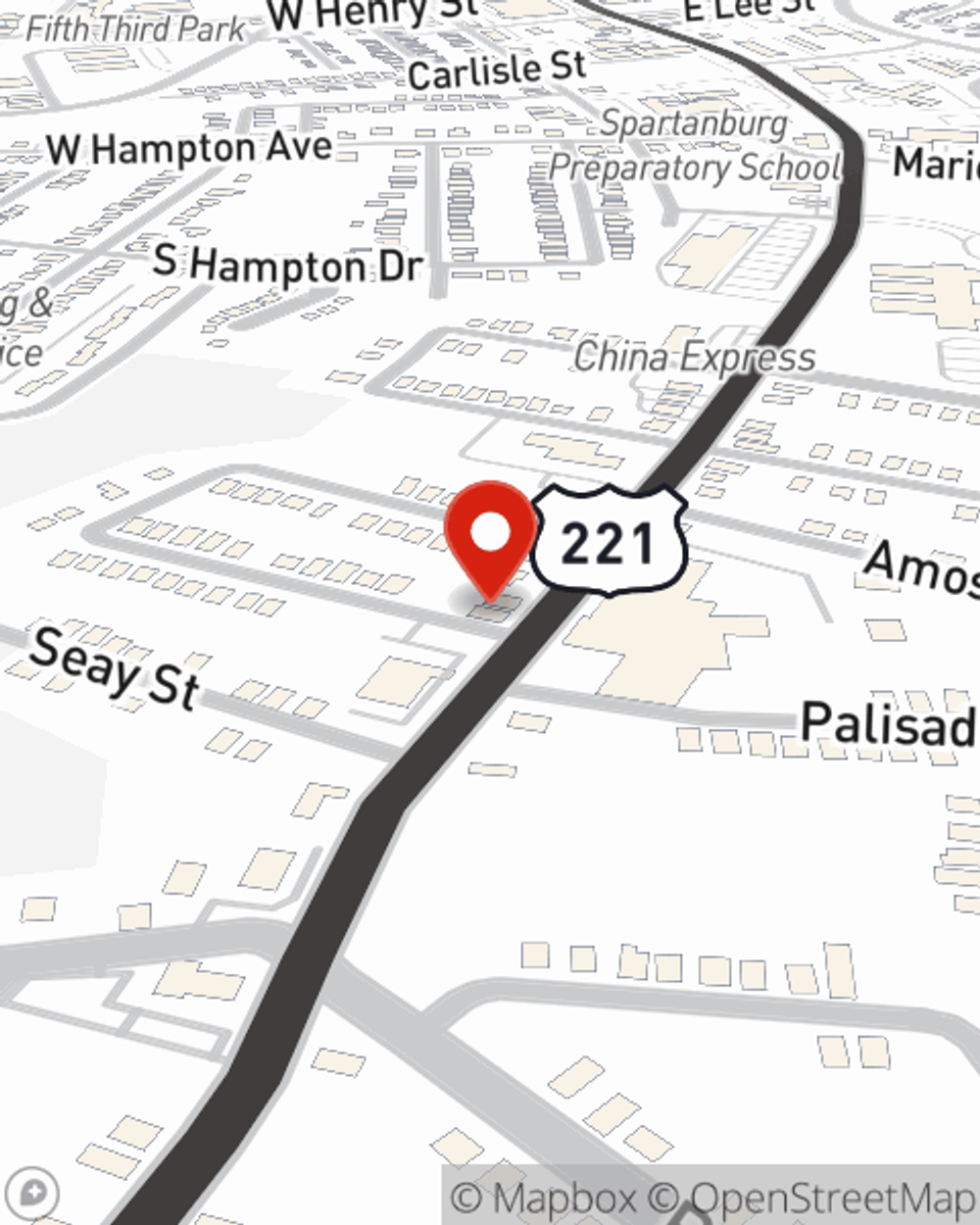

Getting started on an insurance policy for your condo is just a quote away. Visit State Farm agent Chesley Ricketts's office to learn more about your options.

Have More Questions About Condo Unitowners Insurance?

Call Chesley at (864) 848-2011 or visit our FAQ page.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Chesley Ricketts

State Farm® Insurance AgentSimple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.